Most children living apart from their parents- including those living with family members- are eligible for child-only (non-needy) TANF cash assistance through the Division of Welfare and Supportive Services, even if the family member they are living with is not eligible.

As a non-parent relative, you may apply for assistance for your child only. Before beginning to apply for any of the TANF programs, it is wise to obtain a copy of the application and the requirements to qualify.

Nevada TANF Benefits are managed by the Nevada Department of Health and Human Services: Division of Welfare and Supportive Services: https://dwss.nv.gov/

In Nevada, Child-only TANF, also known as Non-Needy Relative Caregiver TANF[1], is available to individuals caring for dependent children[2] other than their own biological children, who meet specified conditions. The first is proof of relation to the child(ren)by birth, marriage or adoption within the 5th degree of consanguinity[3],[4]. This is most commonly proven by birth certificates for the children and everyone related, from the child to the caregiver. Another condition is that the biological parents do not reside in the home[5], or if they are in the home, have been declared by the court to be mentally or physically incapable of caring for children[6].

As of July 1, 2020, fictive kin caregivers of children in foster care are eligible to receive child-only TANF benefits for up to six months while they pursue the kinship licensing process. Applications provided at Foster Kinship and must be submitted through the appropriate child welfare agency.

Full-time relative caregivers do not need legal custody or guardianship to apply for assistance on the child’s behalf.

IMPORTANT: WRITE TANF CHILD-ONLY (TCHD) on the TOP OF YOUR APPLICATION!! This will hopefully help avoid any mistakes where your application is rejected because it is unclear you are not asking for assistance for yourself. Be sure to check “NONE” on each line for all adults and non-kinship children in the household, and “TANF” on each line for the children.

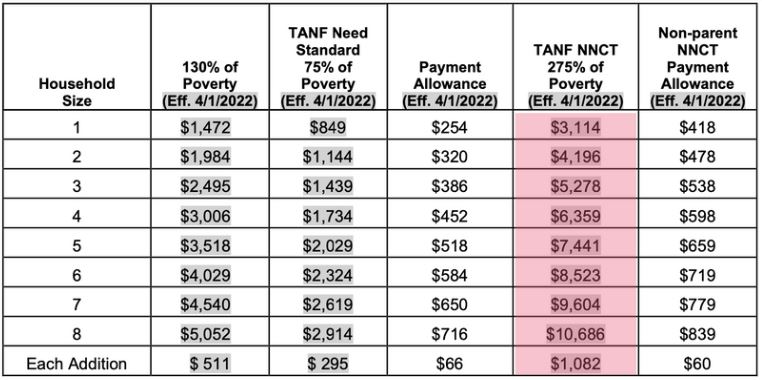

Non-Needy relatives can receive a small cash stipend each month to provide for the care of the children. Your household income cannot exceed 275% of the poverty guideline (versus 130% of poverty for regular TANF programs). So even if you have applied for assistance for yourself in the past and been rejected you may be eligible for child-only TANF now.

Once your household has qualified for NNRC TANF, only the CHILD’S INCOME IS COUNTED TO DETERMINE BENEFITS. For example, some children may have income if they receive disability or death benefits.

Description of Program:

A Non-Needy Relative Caregiver (NNRC) is a relative, other than a legal parent, not requesting assistance for themselves and only requesting assistance for a relative child(ren). The NNRC must be a relative of specified degree and the child must be living in the home of a specified relative.

The child(ren) must be living with the individual applying for assistance on their behalf that provides care and supervision and is the child’s (not all inclusive):

NNRC TANF is a Child only program (TANF-CHILD) – These are households with no “work eligible” adults, is considered assistance; and time limits do not apply. This program is designed for households not having a work-eligible individual. No adults receive assistance because the caregiver is a non-needy relative caregiver.

Income Test and Payment Amounts:

The gross income test is 275% of the Federal Poverty Level. This test will be applied to all NNRC households at initial eligibility, when a change of countable income is reported, at the Review of Eligibility if new or increased countable income is reported or a new household member who is related to the child(ren) and has countable income is reported.

The countable gross earned and unearned income will be determined according to the current TANF policy of all adults and children in the household with a relationship (by blood or marriage) to the child(ren) for whom assistance has been requested.

Earned income disregards and work expenses are not applied and TANF assistance is exempt.

All adult household members whose income is countable in the gross income test, who did not sign the application form, are required to sign an Interface Consent, Form 2179-EE, allowing DWSS to interface with other federal and state records for eligibility and income verification.

If the total countable gross income is below the 275% income test, only the child(ren)’s, income, and resources are used to determine the TANF Kinship Care eligibility and payment. If the child has no income, you should receive the maximum payment per child.

The following table provides a guide to income levels and maximum payment amounts. Maximum payment is issued when there is no countable income.

Health Insurance for Children:

Households who apply for TANF and are also interested in medical assistance must also apply for TANF-Related Medicaid (TRM).

Medical coverage through other Medicaid programs such as the Children’s Health Assurance Program (CHAP) is available to minor children and pregnant women.

Application Process :

Apply online or at the office closest to you- if you do not go to the right district office staff will inform you of the correct office location. If you ask, staff will accept your application and forward it to the correct office. The best days to walk in are Monday and Friday, when no appointments are scheduled. If you apply online or mail your application, you will receive a “flexible appointment date” in the mail. You can show up ON OR BEFORE your appointment date. You are guaranteed to be seen if you sign in by 3:00 PM on the date of your appointment.

IMPORTANT: WRITE CHILD ONLY on the TOP OF YOUR APPLICATION!! This will hopefully help avoid any mistakes where your application is rejected because it is unclear you are not asking for assistance for yourself. Be sure to check “NONE” on each line for each adults in the household, and “TANF” on each line for the children.

Documents Needed for Application (https://dwss.nv.gov/

You need proof of the information provided, so it’s very helpful to bring as many of the following items as you can:

Child Support Enforcement:

All cases for Temporary Assistance for Needy Families (TANF) and medical programs where the adult and child(ren) receive Medicaid must be referred for Child Support Enforcement. : The responsible relative caregiver who is applying for or receiving TANF NEON or Child Only cash assistance must cooperate with the Child Support Enforcement Program (CSEP) requirements by:

Failure to cooperate without good cause, will result in the denial or termination of TANF NEON, Child ONLY and/or TANF-Related Medicaid (TRM) for all household members. Medicaid from another program will be considered for the child(ren). If the responsible adult is a pregnant woman, she will continue to receive pregnancy related Medicaid coverage during her pregnancy.

The relative caregiver has the right to claim “good cause”, and request a determination of its validity, for not cooperating with CSEP.

Still have questions? Foster Kinship offers free TANF application sessions and an on-site DWSS worker. Call (702) 546-9988 for an appointment.

DWSS MANUAL Footnotes:

[1] 1010.2.3 Non-Needy Relative Caregiver A Non-Needy Relative Caregiver (NNRC) is a relative, other than a legal parent, who is not requesting assistance for themselves and only requesting assistance for a relative child(ren). Only one non-parent caregiver may be included as a needy caregiver and they must be a relative of specified degree (see manual section A-300). See manual section A-2600 for eligibility requirements and C-140 for payment amounts.

[2] 323 DEPENDENT CHILD An eligible child must: ● Be under age 18; or may be age 18, and regularly attend high school or high school level training full time, and is expected to graduate before or during the month of their nineteenth birthday, ● Live with a relative caregiver who meets relationship requirements, ● Never have been married, ● Meet citizenship requirements, and ● Not be receiving SSI. The household may be composed of the parent(s) or relative caregiver of a child who receives SSI, federal, state or local foster care payments or adoption subsidy payments, even though the child may not be included for assistance.

[3] 321 Caregiver: The caregiver must be present in the home and supervise/care for the child. The caregiver’s relationship to the child must be as follows:

Relationship extends to the spouse/domestic partner of the listed relatives, even after the marriage/domestic partnership is terminated by death or divorce/domestic partnership termination. Common law marriages are not recognized in Nevada.

A caregiver meets the relationship requirement, even if a court has jurisdiction over the child or any agency is the child’s custodian. If a child lives with a custodian designated by the responsible agency, that individual must meet the relationship requirement.

Relationship of the caregiver may extend beyond the specified relative list upon a finding of hardship by the Division Administrator. A finding of hardship may not be granted to an individual who is not related by blood or marriage to the child. The office manager or supervisor will document the case circumstances in a memorandum to the Chief of Eligibility & Payments, requesting a hardship determination. Only one non-parent caregiver may be included as a needy caregiver. See manual section A-600 for budgeting.

[4] RELATIONSHIP

Alternate Sources

[5] TANF Cash Programs 1010.2 Child-Only Program This program is designed for households who do not have a work-eligible individual. The adults do not receive assistance either due to their ineligibility (COS & COA) or because the caregiver is not the child’s parent (Relative Caregiver) and not requesting assistance for themselves (CON & COK). Categories of Child-Only households include: Ineligible Adult(s) Child Only Citizen (COA); SSI Adult relative caregiver (COS); Relative caregiver (CON); Kinship care relative caregiver (COK) Child-Only COS, CON and COK cases must be registered in the system with the youngest child as the Head of Household (HOH).

[6] 330 WHO IS INCLUDED The household may not exclude a required member from the assistance unit. If necessary verification is not provided for a required member, the entire household is ineligible. Always include the following in the assistance unit: 1. Eligible child(ren). 2. Unless otherwise ineligible, include the needs of natural/adoptive parents (regardless of marital status) and siblings (including legally adopted, step- and halfbrothers and sisters). This includes being forced to stay the night or reside at a different residence due to homeless situations or temporary shelter requirements. 3. Any otherwise eligible adult relative caregiver who meets the relationship requirements and applies as a needy relative caregiver. 4. An alleged father of a child (not an unborn child) if presumptive parentage is established or not rebutted. 5. An otherwise eligible stepparent who chooses to be included. 6. If the child lives with a natural/ adoptive parent and a relative who has a court order declaring the parent mentally or physically incompetent to care for the child, the relative guardian may apply for assistance as a needy or non-needy relative caregiver. The natural/ adoptive parent is included for assistance.

PLEASE NOTE: Foster Kinship is not a representative of DWSS and encourages all relative caregivers to speak to a caseworker at the closest welfare office for specific answers to their particular situation. Updated 4/5/22.